What Are Liens and How Do They Affect Home Sales?

What is a lien? Basically, a lien is a right to keep possession o property belonging to another person until a debt owed by that person is discharged or satisfied. Many homeowners wonder how liens impact their ability to sell property. If you're thinking about selling a home with liens, it's important to understand the different types and how they can be addressed. It is extremely important to advise your realtor immediately if you are aware that you have any of these liens on the home you are planning to sell.

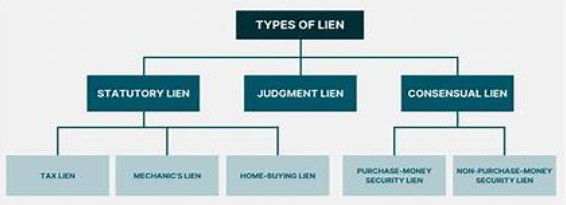

Types of Liens That Can Affect Your Home Sale

Court-Ordered Liens

These result from legal judgments against you. When someone wins a lawsuit against you for money, they become a "judgment creditor" and can place a lien on your property. These liens typically remain on your property for 10 years in Texas and cannot be negotiated since they're court-ordered. However, they are the only type of lien that might be removed through Chapter 7 bankruptcy.

Automatic Liens

These are created by law without requiring a court judgment:

Child Support Liens

Applied when someone falls behind on child support payments. These remain until paid off or until the property sells. The good news is that these can often be negotiated down and sometimes temporarily lifted to allow a house sale.

Applied when someone falls behind on child support payments. These remain until paid off or until the property sells. The good news is that these can often be negotiated down and sometimes temporarily lifted to allow a house sale.

Property Tax Liens

These typically take priority over all other liens. Government authorities can force a property sale to collect unpaid taxes. Mortgage lenders often pay overdue property taxes themselves and add the amount to your mortgage to protect their interests. These are very difficult to negotiate, especially county taxes in Texas.

Federal Tax Liens

The IRS can be challenging to negotiate with, though professionals may have better success. For example, in one case, a homeowner faced a $2 million federal debt on a $100,000 home due to her husband's fraud. With professional help, she received a partial lien release that allowed the sale to proceed, with all proceeds going toward the debt.

HOA Liens

Homeowners' associations can place liens on properties when fees aren't paid and may even force foreclosure. While HOAs

prefer not to negotiate, they sometimes will if necessary.

Contractor Liens

Repair contractors can place liens if they aren't paid. While you should pay legitimate debts, these liens can sometimes be

negotiated. These are sometimes referred to as Mechanics Liens, not to be confused with an automobile “mechanic”.

Municipal Liens

Cities may place liens for issues like unmaintained properties, additional assessments. These typically must be paid in full.

Storage Facility Liens

Storage businesses can place liens on stored items to secure unpaid fees.

Seller Financing Liens

When a property seller finances part of the purchase, they retain a lien until fully paid. These can be difficult to negotiate, in fact a mortgage is a form of a “lien” – a lien is an encumbrance – encumber means ‘a weight placed on something making it more difficult to move.’

Medicaid Liens

Medicaid can place liens for medical expenses, including nursing home costs. These liens affect the estate after death but can

sometimes be negotiated.

Second Mortgages

Home equity loans are considered "junior (or secondary) liens" compared to the primary mortgage. If the primary lender forecloses, junior liens may be eliminated, giving second lenders incentive to negotiate.

Seeking Professional Help

Dealing with liens is complex and best handled by professionals. Experienced negotiators can often secure better outcomes than individuals attempting to negotiate on their own. When creditors understand that their interests are better served by compromise, they're more likely to agree to reasonable terms.

Professional assistance can be particularly valuable in cases involving multiple liens or complex financial situations. Experts know how to leverage negotiation tactics that appeal to creditors' bottom-line interests rather than simply pleading for sympathy.

SHOW LOVE TO SENIORS